Appeal to Today’s Borrowers with a Smart Alternative to Title Insurance

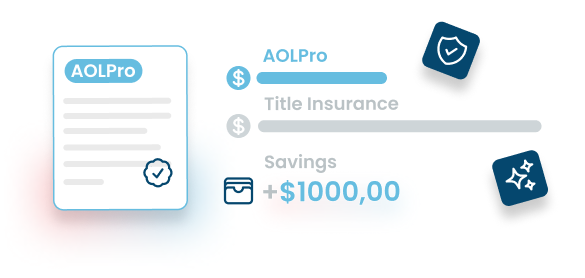

Stand out in a competitive market with AOLPro. Offering our insured attorney opinion letter helps you attract today’s cost-conscious borrowers, saving them $1000 on average.

If you can offer a more cost-effective solution that brings someone new to the table, why wouldn’t you?

The AOLPro platform enables existing title and settlement providers to produce white labeled, fully insured attorney opinion letters at scale. The AOLPro integrates seamlessly with existing processes to enhance operational efficiency, ensure compliance, and provide a cost-effective alternative to title insurance.

Lower Closing Costs

Less expensive than title insurance in many places, saving homeowners an average of $1000 in closing costs. That is money back into the pocket of the consumer.

Streamlined Integration

Utilizes existing processes and integrates with major loan origination and title production systems to ensure a seamless transition with minimal disruption.

Simple Claims Process

Facilitates a more straightforward claims process supported by AM Best A Rated insurance carriers, eliminating inefficiencies created by the traditional title insurance agency model.

Competitive Advantage

The first risk-neutral title insurance alternative that aligns cost with risk, allowing you to offer a more competitive product and gain additional business.

AOLPro’s Undergo a Thorough Review Process Similar to Traditional Title Policies

We’re pulling the same information, the same data. It’s being put into the title production system in the same way. And then when it’s mapped over into AOLPro to produce the AOL, the checklists are embedded in the system and it’s a question and answer process that both the title provider and then the attorney go through to verify that all the information is correct.

How AOLPro Works

Explore the AOLPro workflow, from order intake to recording. This detailed overview illustrates how AOLPro seamlessly integrates with existing processes and systems to ensure a streamlined production process.

AOLPro Production

The AOLPro process begins with API-driven data aggregation from multiple sources, including title data, public record data, and tax records.

This is followed by data processing, which may be automated depending on client integration capabilities, and thorough search and exam procedures to generate a Preliminary AOLPro Report.

Our comprehensive review process ensures that each Preliminary AOLPro Report is accurate and compliant.

Curative Process

Once the preliminary review is complete, any gaps or issues in the chain of title are addressed using task-based curative processes that are embedded in the AOLPro Platform.

Once any issued are cured, an updated AOLPro is generated and a quality control review is completed.

Attorney Review

After the Lender’s Closing Instructions are received, the Final AOLPro Package undergoes a detailed, checklist-based review process by an experienced attorney.

This ensures that all requirements have been met and that the AOLPro is accurate, complete, and compliant. Once the attorney review is complete, a conditional AOLPro is issued.

Closing Process

Closing documents are packaged and prepared for signature.

Closing, settlement, and escrow processes are completed, aligning with existing expectations and SLAs.

Post Closing

Once the closing documents are signed and a post-closing QC check is performed, the Final AOLPro is issued.

Even though the AOLPro provides coverage through the time of recording, there is no need to wait for the recorded documents to issue the Final AOLPro.

Recording

Once the post-closing QC is complete and the Final AOLPro has been issued, closing documents are sent for recording and the AOLPro is reported to the insurer. This is the final step to ensure that you are fully covered with an AOLPro.

I think we’re going to see a lot of savings for the borrower, a lot of reshuffling in the capital markets, and reshuffling in the traditional title insurance space.

If you’re not providing AOLPro, you’re losing business.

AOLPro Coverage Comparison

Not all AOLs are created equal. Unlike traditional options, our modern, insured AOLPro offers coverage comparable to title insurance, protecting homebuyers, lenders, and future investors alike.

Cut Costs, Not Coverage.

It’s simple and convenient to implement, ensuring a seamless process from start to finish. AOLPro can be integrated in multiple ways to suit different lending needs:

Existing Providers

Onboard your current title and settlement service providers to the AOLPro platform and continue assigning work to them.

Captive Title Agency

Use the AOLPro platform with your own captive title agency to streamline your processes.

Alita Network Providers

Leverage our network of approved national and regional service providers already on the AOLPro platform for seamless integration and service delivery.

Exclusive Benefits for AOLPro Licensed Providers

Join the elite group of AOLPro licensed providers and gain access to exclusive resources designed to enhance your service capabilities and streamline your operations. Experience the Alita difference with specialized support at every step.